Category: Uncategorized

When Is The Best Month To Sell Your Property?

April 14th, 2024

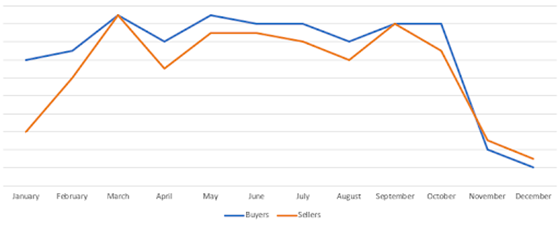

Estate agency is a very seasonal business, with buyers & sellers flipping in and out of buying depending on the time of year.

Here’s a short but sweet summary of how a typical year in property sales plays out:

Buyer activity sees a sharp uptick in the New Year, where buyers make a decision over the festive period and make a New Years resolution of “I’m going to buy a house this year”, however, there are fewer sellers at this time.

During the first quarter though, the number of sellers builds, with the peak of enquiries, new properties to the market and sales agreed, spanning March/April.

Contrary to common perception, Easter itself isn’t that busy. Clients expect a rush of viewings over a typical Easter weekend in April, but in reality, people are either with family or they’re away. So Easter itself isn’t that great a time to put your house on the market but it’s the weeks leading up to Easter and weeks following Easter that have good levels of activity.

Once Easter is out of the way, we see May & June settle to similar, if not quite as high levels, as March, but again you have a couple of Bank Holidays in May. Although the common perception is that it’s mega busy on bank holiday weekends, there isn’t a noticeable difference in the activity on these days. If anything, the viewings on those weekends are stretched out over 3 days, rather than being done over a normal weekend, so it’s not like there’s an increase in viewings just because it’s a Bank Holiday.

Then comes the holiday period. Twenty years ago, it was as quiet for sellers as it was buyers during July & August, but recently, we have seen the number of buyers purchasing in August is consistent with the previous few months, yet the number of sellers falls off – is that because they think, or are being told that buyers go on holiday, or is it because they are on holiday themselves?!

September brings a burst of activity with people coming back from holiday and putting their houses on the market, which in turn attracts more buyers into the market, everyone dreaming of being moved in by Christmas. October drops a tiny notch, November drops a bigger notch and December…well, it’s more than a few notches! Aside from the merriment of Christmas drinks and get-togethers with colleagues & suppliers, Christmas is not a great time to be an estate agent! 😬

Come November, people know how long it takes to move house and so they usually resign themselves to ‘staying for one more Christmas’, which is why we see a fairly big drop in November, with December obviously being a time where people worry about anything other than moving home!

Most buyers want to be in their new homes for Christmas, which I am on the fence about. I think I would rather move in the New Year and enjoy some time to get comfortable and do any work in my new home, before I invite anyone over for Christmas – moving a week or two before Christmas sounds like a level of extra stress which is definitely not needed! But each to their own…

As a seller, there are some very obvious times to put your house on the market – March (depending slightly when Easter falls), May & September. But then there might be some less obvious times – January has a lot of buyers floating around normally and August has become a decent month to get your house on the market, so don’t discount those months either.

I would say that, other than the end of November/December, there is no bad time to put your house on the market. If you need or want to move, then you need to get your house on the market and as long as you have covered all bases from a marketing, presentation and pricing point of view, your property will usually sell in any market, at any time of the year.

If you are thinking of moving or struggling to sell, get in touch today and let’s chat about getting you to where you want to be.

Get in Touch

Happy Seller, Happy Buyer, Happy Agent!

January 30th, 2024

Delivering impeccable service to both sellers and buyers is the definition of success for me. Here’s the story…

Sheila approached me following a previously unsuccessful attempt to sell her property. We spoke on and off for a few weeks and I was invited to meet with her at her beautiful home in New Mills.

We had an open and honest conversation and agreed to work together.

Sheila felt best placed to show her home and in this instance, it was absolutely the right thing to do. After a steady stream of viewings, we found our buyer who was excited to be relocating to the area. All was progressing well until the lower chain broke down. Thankfully they resold quickly and we pushed on through for another 8 weeks until completion mid January.

The key to the success of this sale was COMMUNICATION. Not only did I speak with my client regularly – whether there were updates or not – but our buyer who becomes EQUALLY IMPORTANT. It sounds obvious, but without a buyer, you don’t have a sale! It’s their money funding your move… Using WHATSAPP and the old school art of CONVERSATION, we worked PROACTIVELY every step of the way.

Now my client has moved on and our buyer is DELIGHTED with their new home.

Here’s my seller’s review in full…

“I recently sold my house through Nikki and she was an absolute pleasure to work with. She’s so professional and knowledgeable. It was so reassuring to know that Nikki was on top of everything, returning calls and messages, chasing things and keeping me calm throughout the process.

I would definitely recommend Nikki, and will definitely use her again in the future.

Thank you Nikki”

And here’s the buyer’s review…

“Just wanted to convey how impressed I was with the service Nikki provided following my recent move to New Mills. She was totally professional at all times but with a personal touch, which made the whole process much less stressful. I would definitely recommend that anyone in the market for selling/buying a house use Nikki Davies.”

I’ll take that! 🥂🏠👩

If you are thinking of moving or struggling to sell, get in touch today and let’s chat about getting you to where you want to be.

Get in Touch

My Staging Tips To Get Your House SOLD

January 28th, 2024

Staging your house for sale can make a huge difference to the offer you receive and the length of time it sits on the market. Statistics suggest a staged home will sell on average 25% quicker than one that isn’t. In this blog, I talk you through some of the staging tips I recommend to clients in order to get their homes sold:

Declutter: When you say “declutter” to someone the first thing that springs to mind is clearing out wardrobes or kitchen cupboards. But have you ever thought of decluttering your furniture? A professional stager actually removes half a homeowner’s furniture to make a house look bigger. Less is more in the world of staging – so have a look around and see what you can throw out, pack away or pop into storage for a few months.

Group Your Furniture: A common staging misconception is that pushing your furniture up against a wall instantly makes the room look bigger. However, the truth is, to make your room look bigger and more inviting then it’s can be best to float your furniture in each room away from the walls. Just remember to make sure that your furnishings are placed where traffic can still flow through the room.

Transform Spare Rooms: Get rid of that spare room that has only ever collected boxes or other junk and turn it into something functional with a purpose. Make it into an extra bedroom, a home office or reading room. Buyers want to see themselves living in the property and this helps them to do that.

Great Lighting: A must when you’re staging your home for sale. You can flood a room with natural light if you put mirrors on the walls opposite light sources. Make sure to include table lamps and floor lights in your rooms as that creates ambient lighting. Never use the light in the middle of your room as your main source of light as it won’t show your room off to its best.

Go Neutral: If you have a brightly coloured room or dated wallpaper, then a fresh lick of paint can go a long way. Off-white, creams and neutral soft grey or beige can transform your home into a modern fresh canvas for a potential buyer. If you do want to be a bit bold then please make sure it’s only on a feature wall.

Use Your Garden: Fancy flowers and floral arrangements can be pricey but you can get the same effect with a simple bunch of flowers from the supermarket or by picking some flowers from your garden. Just keep the arrangement simple and throw in a little bit of colour. Flowers can instantly bright up a room.

Quick Kitchen Facelift: Give your kitchen an instant facelift by painting cabinet doors or drawers or by vinyl wrapping them. It’s a cost effective solution and the results can be incredible. Also, tackle your bathroom by freshening up the grouting or sealant for quick results.

Finish Repairs: Unfinished home repairs can really put off potential home buyers – it creates the impression of neglect and a general lack of care for your home. Does the paintwork need touching up on the banister? Is the door handle hanging off? Fix them! Don’t give a buyer ammunition to negotiate a lower price for your home. So finish those repairs you’ve been meaning to do for years and you’ll reap the rewards.

Clean Your Home: I’ve saved the best for last because this is the MOST IMPORTANT tip- clean your house from top to bottom. A dirty house is a massive turn off for potential buyers. Make sure your home is spotless, scrub the kitchen and bathrooms and eliminate any odours- especially if you have pets or smoke. If you can afford to then get professional cleaners to come in and blitz the place, as buyers want a nice, fresh welcoming home they can see themselves building a life in.

These are just a few of the simple and affordable tips that can make a huge difference to the sale of your house.

Thinking of selling? Get in touch today for a FREE home consultation and valuation.

Get in Touch

What Does “Position To Proceed” Mean?

January 26th, 2024

“Are you in a position to proceed”, is a phrase you might hear from estate agents when going out to view a house or enquire about a property, but some people aren’t sure what this means. So here’s a simple explanation of what ‘position to proceed’ means and why it’s important for estate agents to know what position you’re in.

Position to proceed is simply a term to find out if you can move ahead with purchasing a property straight away.

Typically, those that are able to proceed are First Time Buyers or cash buyers, those in rented or temporary accommodation or those that have a property which is ‘sold, stc.’

If you need to find a buyer for your own home in order the buy the next one, and it is not on the market, or it is still For Sale, then you’re not in a position to proceed.

Now some clients in the past have said to us that they’re in a position to proceed, because even though they haven’t sold their own property, they are happy to proceed to get a survey done and order land registry searches.

While this might be the case, there is going to be a point in proceedings that the solicitor or the lender will put a stop to this because you usually need to have sold your own home in order to get the next mortgage, or exchange contracts. So, although you might be willing to proceed, you’re still not in a position to proceed.

For estate agents, it’s crucial to get this information for the seller so that they know who they are showing round and what the likelihood is of an offer that can proceed and it’s something sellers expect to have information on, so it’s a part of the service.

I’ve had a number of selling clients in the past refuse viewings from those that are not in a position to proceed and while I strongly advise against this, if these are the sellers instructions, then as their agent, I have to act upon those instructions.

What I’ve found over the years is that if you aren’t in a position to proceed, then it makes it much more difficult to secure your next property and our advice is always to get yourself into a position to proceed to give yourself the best chance of selling.

The concern is always that you could end up agreeing a sale on your own property and then have nowhere to go and while these are genuine concerns, we think that most customers would rather not be able to find somewhere, than to miss out on their dream home when it does eventually come on the market..

Thinking of selling or struggling to sell your Stockport property?

Get in Touch

The Lifecycle of Home Ownership

December 24th, 2023

There is, of course, no real standard home ownership journey, and what that lifecycle looks like, but here I’ll describe what I often see.

What tends to happen is that first time buyers will enter the market by buying a 1 or 2 bedroom flat or apartment, and, occasionally, a small starter home, depending on the area they’re in.

Typically, they will stay here for between 2 and 5 years and then move on to the next property which may be a 2 or 3 bedroom house. The stay here will typically be 5-7 years and by this time, the owner will have probably got married and had children, or be planning a family.

What we then see are one of two things – either the owner(s) will stay put for a few more years whilst the children are small, and then move to their ‘forever home’ or they will move before the children arrive.

Either way, the next move is normally the big one, where they’ll really stretch themselves to get to their ‘forever home’. That forever home is the one they’ll stay in for the next 25-30 years, until they start to think about retirement. At that point, they’ll normally downsize to something smaller to help pay the mortgage off a few years early and to help with their general retirement funds.

Although the above is your standard ‘journey’ and lifecycle of homeownership, of course, it’s never quite as simple as that. Divorce, debt, death, redundancy, promotions, and the economy, can all play a part in whether your property ownership lifecycle happens in the ‘normal’ way.

Over the years, we have seen a trend for people who are perhaps a few years into their ‘forever home’, then go off and buy one or more properties to rent out.

We’ve also seen a steady rise in the number of people at the end of their ‘forever home’ journey who decide not to downsize and instead release equity which helps them to fund their lifestyles and also allows them to give some of the money to the children, ironically, to help them on the housing ladder!

Whatever direction your journey is taking, you need a good property consultant to help you throughout that lifecycle.

Get in Touch

The Magic of a Well-Prepared Home: Why You Should List Early 2024

December 18th, 2023

Like so many things in life, when it comes to selling your home, preparation can be the key to success. While many homeowners consider listing their properties in the spring or summer, there’s something truly magical about getting your home ready for an early sale. In this blog post, we’ll explore the importance of a well-prepared home and why listing early can work in your favour.

Creating a Strong First Impression

The early bird catches the worm, and the same principle applies to homebuyers. Listing your home early in the year allows you to create a strong first impression in the minds of potential buyers. A well-prepared home stands out in the market and piques the interest of those who are actively searching for their next property.

Efficient Decluttering and Cleaning

The process of decluttering and deep cleaning your home can be more efficient when you’re not rushed. Listing your property in the early months of the year provides ample time to go through your belongings, organize, and make your home sparkle. A clean and clutter-free space is more appealing to buyers.

Time for Repairs and Updates

Early listing gives you the time needed to address any necessary repairs or updates. Whether it’s fixing a leaky tap, repainting a room, or replacing outdated fixtures, taking care of these tasks in advance ensures that your home is in its best condition when it hits the market.

Access to the Best Real Estate Professionals

Top real estate agents often have fewer clients in the early part of the year, allowing them to provide more dedicated attention to your property. By listing early, you increase your chances of working with experienced and successful agents who can help you navigate the market effectively.

A Well-Researched Price Strategy

Determining the right price for your home requires thorough market research. Listing early gives you the opportunity to study recent sales and market trends, allowing you to set a competitive and appealing price. Well-researched pricing can attract motivated buyers and lead to faster sales.

Attracting Motivated Buyers

The start of the year is often associated with fresh beginnings, and many potential buyers are eager to find their dream home. Listing early can attract motivated buyers who are ready to make decisions promptly. Your well-prepared home can be their top choice.

Enjoying a (relatively) Stress-Free Sale

By preparing your home for an early sale, you can reduce the stress associated with last-minute preparations and showings. A well-prepared home allows for smoother transitions and fewer disruptions to your daily life during the sales process.

We believe listing your home early in the year affords many benefits – it allows you to create a strong first impression, efficiently declutter and clean, and take care of necessary repairs and updates. You’ll have access to experienced real estate professionals and can establish a well-researched price strategy to attract motivated buyers. Additionally, the early sale of your well-prepared home can lead to a smoother and more stress-free experience. Don’t miss the magic of listing your home early in the year; it could be the key to a successful sale.

Get in Touch

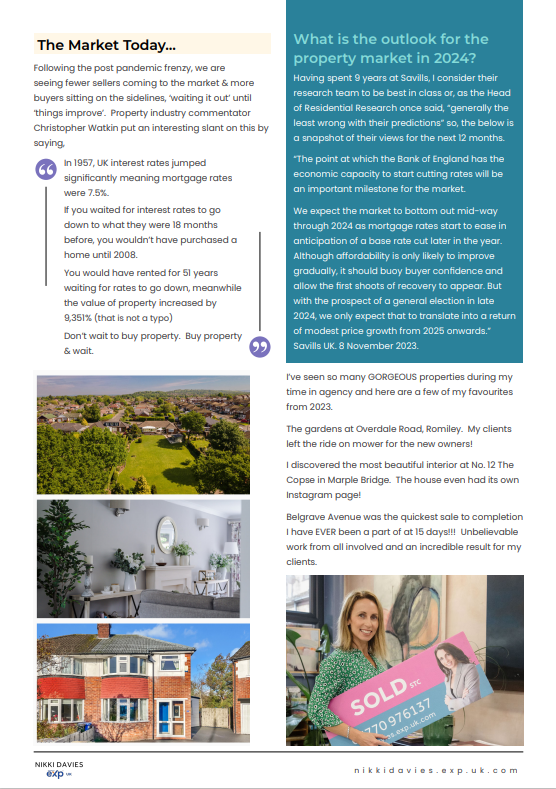

NEWSLETTER – December 2023

December 8th, 2023

5 Reasons To Sell Your Home In December

November 27th, 2023

The holiday season is almost upon us, which means that many potential home sellers are wondering whether it’s a good idea to put their house on the market during this time of year. While it can be a little more difficult to sell a home in December, there are still some compelling reasons why you might want to take the plunge and list your property this month.

Here are 5 reasons why selling your home in December could be the right decision for you:

1. Low inventory: During the winter months, many sellers take their homes off the market due to the holidays and inclement weather. That means there are fewer homes on the market, making it easier for yours to stand out among potential buyers.

2. Less Competition: Because so many people wait until the spring to list their homes, there tends to be less competition in the winter months—which translates into less pressure when pricing your house. This can make it easier for you to get a competitive asking price, as you won’t have as much competition from other sellers in your area.

3. Serious Buyers: Most buyers who are looking for a new home in December tend to be serious about finding a property quickly and efficiently—which means that anyone who contacts you with an offer is likely genuinely interested in purchasing your home. As opposed to spring or summer buyers, winter buyers tend not to waste time—so if you receive an offer from them, chances are they mean business!

4. More Time for Moving: If you do end up selling your home during the holiday season, you will likely have more time than usual to move out once everything closes and all of the paperwork has been signed. Because of the Christmas holidays it gives you more room to plan and organise things such as packing supplies, movers, etc.

5. Positive Attitude: Finally, people tend to be happier and more optimistic around Christmas—and that includes prospective buyers! A positive attitude can go a long way towards making potential buyers feel more secure about signing on the dotted line; plus, because everyone is usually busy with holiday festivities, there tends to be less stress involved when negotiating during this period than at other times throughout the year!

Selling your home during December certainly presents its own unique set of challenges—but it also offers some distinct advantages over waiting until the New Year. If done correctly and strategically planned out ahead of time, listing your property this month could prove very beneficial both now and down the road.

So don’t let yourself get overwhelmed by all of the hectic holiday activities; instead use them as motivation and encouragement towards achieving success while selling your home this December!

Thinking of Selling or Struggling to Sell? 4 Reasons to Get Ready for the Boxing Day Buyer Boom!

November 27th, 2023

Are you currently on the market and struggling to sell? Or perhaps you’re thinking of selling your home in the new year?

A lot of people think putting your house on the market during the holidays is a crazy idea – it’s actually not.

If you’re wanting a quicker and smoother sale then launching your house to the market on Boxing Day is one of the smartest things you can do.

Why? Well here are four reasons…

House Hunters are Searching in their Droves during the Festive Period: Between Boxing Day and the end of January, Rightmove say there are more than 150 million visits to their website which means your perfect buyer could be a click of the mouse away if you launch (or relaunch) at the right time.

Why Not Capitalise on the Boxing Day Buyer Boom?: Boxing Day is the most popular day of the year for buyers to search for a new house on Rightmove. In fact, web traffic to the property website soars by 70% the day after Christmas. Plus, the number of people browsing properties on Rightmove during the post-Christmas Day period has been increasing every year, with visits on Boxing Day last year 54% higher than the previous year.

Get Ahead of Your Competition: By launching (or relaunching) your house to the market on Boxing Day you will get your property ahead of the January rush of people putting their houses on the market. By the time they take action in January, your property could already be sold!

A New Year, New Start : After Christmas people start looking for a change and new adventures, for many people this means moving to a new house so it’s important to have your property in pole position to be found online. By launching to the market on Boxing Day, this can really help you to do that.

So there you have it, 4 reasons why it’s a great idea to launch (or relaunch!) your home to the market on Boxing Day.

If you have any questions about getting your house ready for sale ahead of the holidays then please get in touch today and we’ll get you Boxing Day ready!

Get in Touch

The Top 7 Things You Need To Know When Moving Home

November 15th, 2023

Get your house valued by 3 different agents before you put it on the market.

Don’t pick the agent that values it the highest, without evidence of other properties sold in the same area.

It’s always best to put your house on the market before you find a property

The estate agent acts for the seller and is there to get the seller the best price possible

Understand the length of time it can take – on average it takes around 14 weeks from when you accept an offer as a seller, or have an offer accepted as a buyer – to move in! That’s a long time!

It can get stressful, but regular communication with your agent and your solicitor is key so you are always in the picture.

Be nice to estate agents – we’re pretty nice people (in general), we offer some great advice (in general) and will help to get you moved 😉