Category: Uncategorized

Rightmove November House Price Index Report

November 13th, 2023

Rightmove have revealed a better-than-predicted year as sellers price more competitively.

Average new seller asking prices drop by 1.7% (-£6,088) this month to £362,143 as more sellers heed their agents’ advice to price right the first time, and temper their expectations in a less frenetic market.

The data points to a better-than-predicted year so far, with available properties for sale now just 1% behind 2019’s more normal market levels, and sales agreed improving this month to 10% below November 2019’s level.

For the full report, click the link.

Get ahead of the game…

November 13th, 2023

Are you considering selling your home but wondering about the best time to do it? You might be surprised to learn that listing your home for sale before January can offer numerous advantages. In this blog post, we’ll discuss the top reasons why selling your home early can help you get ahead of the competition and achieve a smoother transaction. From attracting motivated buyers to setting a competitive price, discover why a pre-January sale can be a game-changer for sellers.

Reason 1: Attracting Motivated Buyers

Selling your home before the New Year’s rush can help you attract motivated buyers. These individuals are often more serious about their home search and are driven to make a purchase decision promptly. By listing your home in December, you tap into a pool of potential buyers who are actively seeking a new place to call home.

Reason 2: Reduced Competition

The real estate market tends to heat up in January as many sellers decide to list their homes after the holidays. By listing your home in December, you’ll have less competition, allowing your property to stand out among the limited inventory. This reduced competition can lead to a quicker sale and potentially even better offers.

Reason 3: Setting a Competitive Price

A lower supply of available homes can give you an advantage when it comes to pricing your property competitively. With fewer comparable listings on the market, your home may be perceived as more valuable, potentially leading to better offers from buyers who want to secure a property before the January rush.

Reason 4: Favourable Market Conditions

December often sees a less volatile market with a more predictable demand for housing. By listing your home during this period, you can take advantage of a more stable environment with steady, interested buyers who are less likely to make impulsive decisions.

Reason 5: Opportunity to Present Your Home at Its Best

Listing your home for sale early gives you ample time to prepare and present your property at its best. You can tackle necessary repairs, conduct any desired home improvements, and even consider professional staging to make your home more appealing to potential buyers.

Reason 6: A Smoother Transition to Your New Home

Listing your home in December often means closing the deal in the early part of the next year. This aligns perfectly with many buyers’ and sellers’ goals for a smooth transition to their new homes, whether it’s for job changes, family needs, or personal aspirations.

In summary, listing your home for sale before January is a strategic move that can lead to attracting motivated buyers, reducing competition, and positioning your home favorably in a stable market. With the extra time for preparation and presentation, you can set the stage for a successful sale and a smooth transition to your next adventure. So, get ahead of the game and talk to me TODAY about listing your home this December.

Get in Touch

Five things that add the LEAST value to your home

November 13th, 2023

Kitchens and bathrooms are the top items that add the most value to your home but you may be surprised to learn what adds the least.

Garden

Gardens can be very high maintenance, depending on the size of them, but you don’t often realise that until you have a garden that needs maintaining. And that’s often why buyers don’t see the value in a hugely improved garden. If they see a shoddy garden that is unkept and needs a load of work, they sort of think “Oh well, we’ll get round to that in the Summer”, whereas if the kitchen is a tad old and tired, buyers are instantly “Well, we’ll have to replace the kitchen and we couldn’t possibly offer anywhere near the asking price because the kitchen needs replacing”

Ironically, if you need to re-patio your garden, put new fencing in and turf it, it can cost more than a kitchen in some instances! But whereas a kitchen will usually add good value on to your home, having a pristine garden will not add as much.

The value of a garden generally comes with its size, rather than the condition of it. So if you’re about to sell, make it tidy, cut the lawn, but don’t go spending thousands on patios, sheds and fencing.

Rewiring

Another huge expense from the king of all trades (that’s a joke in case you are a tradesperson from another sector – my electrician said that to me when he rewired my house and it made me laugh!)

Rewiring a house is no small job. It often requires the property to be vacant, can take a couple of weeks (depending on the size of the house) and then still needs patching up after they’ve been and created havoc in the property. The problem with wiring is that it’s behind the walls and no one can see it, so there is little value there. Sure, if you have a house that has the oldest wiring in the world, you need to get it rewired, but as a job to do if you’re about to sell, forget it.

New Double Glazing

Double glazing. We hate double glazing. We hate double glazing sales people. And now we hate the fact that it doesn’t add any value!

But it just doesn’t. It keeps you warmer. It’s quieter. And it lowers your energy bills. Allegedly. But it doesn’t add value to your home. Not enough to justify the expense. So if you’re going to do double glazing, then do it for yourself, rather than the value it adds to the property.

New Boiler

Like rewiring, but not quite as messy and around the same price. A new boiler probably adds more value than rewiring or new double glazing, but if it is just ‘old’, but works, don’t bother replacing it to add value. Only do it if it conks out, you’re feeling cold or you have some spare cash!

Extending without providing extra rooms

A classic mistake made by more people than you’d imagine. Adding an extension, without adding rooms, although adds value, won’t add as much value as adding rooms.

Houses that have their kitchen extended to create just a bigger kitchen, rather than a kitchen/diner or kitchen/breakfast room are usually making a mistake.

Similarly, extending upstairs to create, say, 3 double bedrooms, instead of two doubles and two singles, are usually making a mistake. They should be creating an extra bedroom. Yes, even if that means 2 doubles and 2 singles – it’s usually worth more than the same sized house with 3 double bedrooms.

Get in Touch

5 Questions To Ask An Estate Agent On A Valuation

November 13th, 2023

You decide you want to move house and you’re not sure of the value of your home, so you have to get the estate agent(s) in.

Firstly, I’d always recommend you get 3 estate agents in to value the property. I know it’s a bit of drag having to listen to the estate agents drone on about how they can help you and what they will do for you, but it’s worth it!

To try and control the conversation, I have outlined the 5 key questions to ask before you decide to instruct anyone to market your home:

1.) The most important question is the value, but it’s probably not the question you think, which is ‘What is the value of my house?’. No, the most important question you can ask the agent is ‘How did you arrive at the figure you have come up with?’

Any agent can value a house, but they have to be able to justify, with comparable evidence of similar properties that have sold, rather than just pointing their finger in the air and, frankly, hoping. If the agent can’t provide comparable evidence, then you should probably consider another estate agent.

2.) The next question is making sure that they will be able to deal with leads that come in to their business. It’s no good instructing an agent, who goes off and does all this marketing, only for them not to be working on a Sunday, for example, or at least having the ability to capture telephone leads on a Sunday.

3.) Thirdly, I would recommend you ask how they plan to market the property. What is their overall marketing strategy? Is it just Rightmove? Or do they have buyers on a mailing list, will they push it out on social media and will they advertise on Zoopla as well (Zoopla claim that 32% of visitors to their site, don’t visit Rightmove, so it would be sensible to choose an agent who is on with both Rightmove & Zoopla)

4.) Next up comes the question about offer negotiation and sales progression. Is it something they do? Does the agent that’s coming out do all this themselves or do they have direct members of staff working for them in the same location as them, or are they based in a call centre 10 miles away. Either is fine, but it’s good for you to know who you will be dealing with this once a buyer is found.

5.) Finally, the question of fees and contracts. Not necessarily how much they are going to charge you, but find out when they are going to charge you.

The direct question to ask is ‘Will you only charge me when the house sells and not regardless of if the house sells? Agents goals should be aligned with the sellers goals, and that is to sell the house, not just get it on the market.

On the contracts question, ask how long you will be tied in for – any more than 12 weeks seems excessive. And also check the notice period – it shouldn’t be anymore than 1 week!

Agents are generally good people and good at their jobs, but the above questions will give you a flavour as to how they work.

Ultimately, probably the most important thing is you have to like and trust the estate agent that you’re going to be using, because it’s likely going to be a working relationship for around 6 months, and perhaps longer!

Property Descriptions – Not To Be Ignored!

July 28th, 2023

Property Descriptions – Are they there to A) pad out the listing or B) provide useful and essential information?

In case you’re wondering – IT’S B!!!!

I love putting listings together but the hardest part for me is getting the description just right. My photographer spends hours editing the video and photographs and I spend the same writing my descriptions. So why then, do some buyers choose to have a brief flick through the photos and go to book a viewing, without reading the VERY IMPORTANT INFORMATION or even watching the video?!

We live in a fast paced world and we’re all so damned busy and I get that, however… Is it better to spend 10 minutes researching a property before booking a viewing or spending an hour or more of your time (and mine) viewing a property that is clearly not meeting the criteria you have set for yourself.

Here are just a few of the reasons why it is crucial to read the property description beforehand:

- Filtering and Prioritising: Property descriptions contain key details about the property’s features, amenities, and location. By reading the description, you can quickly filter out properties that do not meet your criteria or preferences. This allows you to prioritise and focus on the listings that align with your needs, saving you from visiting properties that are not suitable.

- Managing Expectations: The property description provides a comprehensive overview of the property’s attributes and condition. It gives you an idea of what to expect during the viewing. By managing your expectations based on the description, you can avoid potential disappointment if the property does not match what you had in mind.

- Planning and Preparation: Reading the property description helps you plan and prepare for the viewing effectively. Knowing the property’s details in advance allows you to come prepared with relevant questions for the seller or real estate agent.

- Avoiding Surprises: A well-written property description should highlight all aspects of the property such as condition and the level of work required. Admittedly this is subjective so when you speak to the agent to book the viewing, ask questions before committing. If there are any potential issues or drawbacks, they may be mentioned in the description. Being aware of such aspects beforehand can help you decide whether the property is worth considering or if it’s better to explore other options.

- Time Efficiency: House-hunting can be a time-consuming process. By reading property descriptions first, you can quickly assess if a property aligns with your requirements. This saves you from unnecessary viewings and allows you to focus on properties that have a higher chance of meeting your criteria.

- Clarifying Doubts: If you have specific questions about the property, the description might address some of them. It can provide essential information, such as the property’s age, recent renovations, or any included furnishings. This can give you a clearer picture before the viewing.

A good listing is an advertisement for the property and should include:

Photographs: The number may vary depending on the property but as a rule 8-16 works well. Not 99 as I saw on one listing!

Video tour: Some agentsuse 360 degree virtual tours which pan around each room. I like a video tour which give more information than the photographs – particularly good for awkwardly shaped rooms or showing gardens off to their full potential.

Floorplan: including room dimensions and total floor area. If you’re upsizing or downsizing, wouldn’t you want to know the room dimensions?

Property description: A brief introduction paragraph with an overview of the property – this might mention it’s condition, location or size – it’s designed to grab your attention. Detail of the property internally (the rooms, their features and the benefit of those attributes (this is advertising) and externally (parking, gardens, views etc).

Additionally: Tenure (if leasehold – any associated charges), council tax band, energy performance rating, catchment schools, transport links and area information.

Having information up front empowers you to make informed decisions, ensuring that your time and efforts are well-utilized during the property search.

Get in Touch

What Is Your House Worth?

July 28th, 2023

We learn this on day one of Estate Agency School* – the short and the sweet of it is that it’s worth what someone is prepared to pay for it.

So, how do you find out what it’s worth without having to put it on the market?

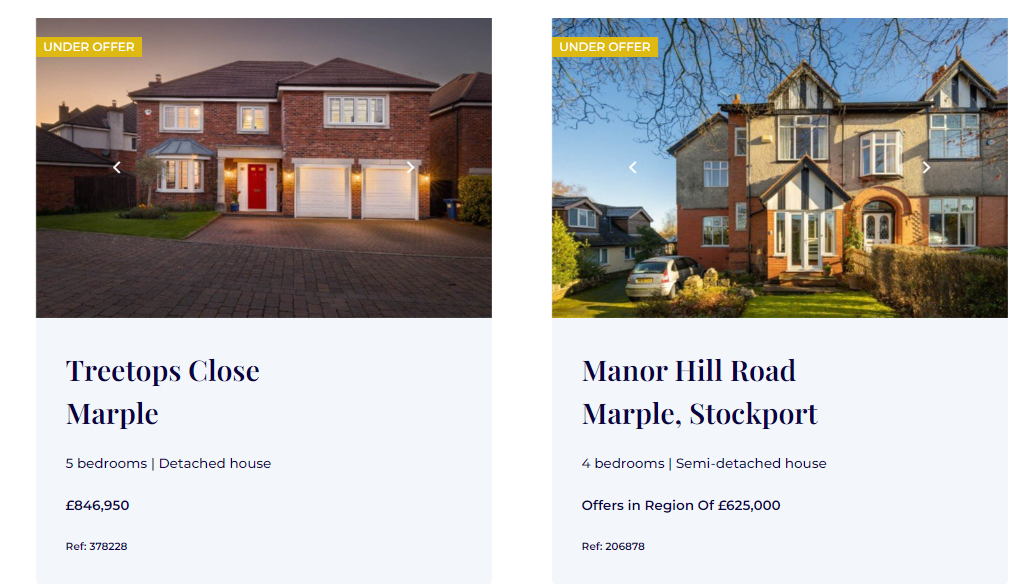

Firstly, take a look at the property portals – Rightmove & Zoopla – to see what properties are on the market, that are like yours. Remember to consider both properties that are ‘SOLD or UNDER OFFER’ and those that are ‘For Sale’. Those that are for sale and have been for more than 6 weeks are generally considered to be overpriced.

Secondly, you can ask an estate agent to come and value the property. Bear in mind that estate agents can’t ‘value’ properties (in fact no one can as it’s only worth what someone is prepared to pay), however, they can give you a guide as to what they think it might achieve and what you should put the property on the market for. They should be able to provide you with information to support their figures rather than dazzling you with a figure you cannot refuse.

The third way is to use an instant valuation tool. This is where you can input your postcode & address, the number of bedrooms you have and other such information, and the ‘automated valuation model’ (AVM) will come back to you with a ‘valuation’ of the property. These are often not that accurate as the instant valuation tool is unable to work out what improvements you have made to the property, or look at hyper local events that may have an effect the valuation.

They’re useful as a guide, but we wouldn’t rely on them as gospel. If you’re thinking of selling or just curious about what the instant valuation tool will say your house is worth, then feel free to have a play around with my instant valuation tool.

The last way to find out what your house is worth is to get a qualified surveyor out to the property. In theory, a surveyor is the only qualified person to ‘value’ a property.

A surveyor will compile a list of comparable evidence of similar properties that sold in the vicinity and, some might say, ironically, will often consult estate agents(!), as well as look at historic data through the remortgage database. They also have access to a more powerful AVM that looks at numerous data points to help them come up with a ‘true valuation’. These valuations are based on evidence and science.

However, that can never account for the buyer who will pay £10k or £20k or even £50k more than the surveyor’s valuation because they want to get their child into the nearby school, or they love the countryside views that someone might have.

So in all honesty, we’re back to where we started, the only way to find how much your house is truly worth at any point in time, is to put it on the market, and see what someone is prepared to pay for it…

By the way, re agency school *there is no such thing but some of us do have formally recognised industry qualifications…

Get in Touch

Are you in a position to proceed?

July 18th, 2023

“Are you in a position to proceed”, is a phrase you will more than likely hear when you enquire about a property, but some people aren’t sure what this means. So, here’s a simple explanation of what ‘position to proceed’ means and why it’s important for estate agents to know what position you’re in.

Position to proceed is simply a term to find out if you can move ahead with purchasing a property straight away.

Typically, those that are able to proceed are First Time Buyers, cash buyers, those in rented or temporary accommodation or those that have a property which is ‘sold, stc.’

If you need to find a buyer for your own home in order the buy the next one, and it is not on the market, or it is still For Sale, then you’re not in a position to proceed.

Now some clients will state that they are in a position to proceed, because even though they haven’t sold their own property, they are happy to proceed to get a survey done and order land registry searches but this isn’t strictly correct. Why? Because there is going to be a point in proceedings that the solicitor or the lender will put a stop to this because you usually need to have sold your own home in order to get the next mortgage, or exchange contracts. So, although you might be willing to proceed, you’re still not in a position to proceed.

For estate agents, it’s crucial to get this information for the seller so that they know who they are showing round and what the likelihood is of an offer that can proceed and it’s something sellers expect to have information on. It’s a part of the service.

I’ve had a number of selling clients in the past refuse viewings from those that are not in a position to proceed and as their agent, I have to act upon their instructions. I will however take each situation on its own merit. Where someone is on the market or about to go on the market but hasn’t yet sold, it is quite possible they could agree a sale on theirs and become proceedable quickly and so it makes sense to show them around. However, someone calling up to book a viewing based on a whim, it’s probably going to be a no from me. My advice is always to get yourself into a position to proceed to give yourself the best chance of securing your next home.

The concern is always that you could end up agreeing a sale on your own property and then have nowhere to go and while these are genuine concerns, in my view, this is better than missing out on your dream home when it does eventually come on the market…

Get in Touch

Spotlight on Marple, Stockport

July 9th, 2023

As a local resident, I can hand on heart say that Marple is truly one of those ‘best of both worlds’ locations – close enough to the hustle and bustle of the city centre and yet you can be in the countryside in just a few minutes.

Since the pandemic, I’ve seen more and more buyers coming in from south Manchester, keen to explore the area and all it has to offer. Although we’re not quite up there with Didsbury or Chorlton, Marple is still a less expensive proposition and here’s a few great reasons to set up home here:

• Two railway stations serve Marple with regular train services into Piccadilly in under 30 mins

• Regular bus services into Stockport, Hayfield, Mellor and Glossop plus a circular service covering Romiley, Marple and Bredbury

• A good number of independent retailers, cafes and bars have opened in recent years

• The Regent cinema is one of the few remaining family run traditional independent cinemas in the UK.

• Great choice of good primary schools and activities available for children and adults including tennis, golf, football, cricket and running clubs

• Plenty of green space – Memorial Park, Brabyns Park, the Roman Lakes, and a bit further out is Etherow Country Park in Compstall and Lyme Park, owned by the National Trust, in Disley.

• It’s a walker’s paradise with walks to suit all ages and abilities and the Peak District is on the doorstep.

• The Middlewood Way is a cycle path, popular with runners and walkers which follows the former Macclesfield, Bollington and Marple Railway line south from Rose Hill to Macclesfield.

• The Peak Forest Canal runs for 15 miles between Ashton under Lyne and Whaley Bridge in Derbyshire, passing through Marple through the famed flight of 16 locks, separating the ‘upper’ and ‘lower’ parts of the canal. Follow the canal path and take in the breathtaking views of the nearby Peak District; you are never far away from some outstanding walks.

• There is a real sense of community and a number of local events are organised including Marple Carnival and the Food and Drink Festival.

If you’d like to know more about life in Marple, get in touch today.

Get in Touch

Should I sell my house?

June 18th, 2023

There are a myriad of reasons why people decide to move and we’re going to run through just a few of them which may help you to decide if it’s the right decision for you.

Children arriving, or to get more space – more commonly known in estate agency as ‘upsizing’

When it comes to upsizing, if you’re struggling with space, you either have to extend, or sell your house.

But if you decide you need to sell your house, then you also need to take a few more things into account…

– What is the balance of your mortgage?

– What equity do you have in your house?

– Do you have any redemption penalties?

– What are you (and your partner) earning?

– What is the maximum mortgage you can get?

– What sort of house will that buy you, in the location that you would like to live?

If everything fits, then, in my opinion, you should sell your house. Typically, people want to be in their ‘forever’ home by the time they are aged 40-45. To achieve this, in our view, if you have the equity and you have the salary to get the mortgage, then upsize rather than extend.

Release equity or the house is too big for you, more commonly known in estate agency as ‘downsizing’

If you’re downsizing, it probably means the kids have grown up and you’re looking to release equity from the house to spend on yourself! And why not?!

The difficulty usually, is to find a property that you are prepared to downsize too, because when you have become used to a certain type of property with a certain amount of space both inside and out, it becomes difficult to find something that offers the equivalent. In fact, it is pretty much impossible! But that’s the trade off – a smaller house, with less space, in exchange for a few hundred thousand pounds in the bank so you can go travelling and live the life you have worked so hard for.

I do see it a lot where people who are thinking of downsizing, decide not too, because they can’t find anywhere to go because they don’t want to compromise, but in turn sacrifice all the dreams they had when they were 45 about travelling the world when they retire…but I get it, it’s not easy, especially when there is an emotional attachment to your ‘forever house.’

The key word above is ‘compromise’, and if you are prepared to compromise for a few hundred thousand quid in your pocket, then you should sell…

But you do also need to consider the following:

– What is your house worth?

– What do you want to be left with once you have moved?

– What sort of house can you afford with the amount you want to be left with?

– Will you be happy in a smaller house?

– What are you going to do with the money once you move – make a list – travel the world, save a bit, buy a Rolls Royce, treat the grandchildren.

Getting children into a new school or a job move, more commonly known in estate agency as a ‘change in circumstances’

A change in circumstances usually means you should sell your home. It’s usually a job move, or wanting to get children into a different school or because you’ve fallen in love with someone who’s in a different area to you. Or perhaps it’s moving to be nearer your grown up children & grandchildren or moving abroad for a different way of life. But inevitably, a change in circumstances like this, often means you have to sell your home.

In most instances, there is the potential to let your property. Again, you have to do a fair bit of homework on what your property is worth both from a sales point of view, and also how much rent you would get for it, then a financial advisor will have to do some number crunching to determine what someone will lend to you if you keep the house you’re in, and all that other magic stuff! Coupled with the mountains of legislation around letting – it is not a decision to be taken without thoroughly educating yourself first.

Still not sure? I’d be happy to explore all your options with you and come to a sensible decision that’s best for you.

Get in Touch

Can I Offer On A Property If I Haven’t Sold Mine?

May 12th, 2023

In short, yes you can. You can offer on any property, on with any agent and the agent is obliged to put the offer forward to the owner of the property.

However, offering on a property when you haven’t sold yours is unlikely to lead to securing the property and getting the owner to take it off the market.

This is because the agent is acting for the seller and as the agent working on behalf of the seller, our job is to mitigate any risk for the owner. This is why agents ask for proof of finances and ‘check chains’ with other estate agents. This is all part of our due diligence so that we can give the seller the whole story and advise where necessary.

So, if you offer on a house and your house hasn’t sold, the agent will put the offer forward, but will often advise the seller not to accept the offer formally. They will instead advise to ‘indicate’ that they would accept this offer should you sell your property. This is the ‘right’ way to do estate agency.

People often question whether this is the right advice or not, but imagine if the agent advised the seller to accept the offer and take their house off the market?

The worst case scenario is that the person who has made the offer never sells their house. It’s not uncommon for houses not to sell. And if someone has their offer accepted where they haven’t sold their own property, it could well happen. If this were the case, then the seller of the property has taken their house off the market and stopped other potential buyers from perhaps buying the property, halting their own onward move. Not advice that acts in the best interests of the seller.

Any questions, get in touch with me today.